Land and Buildings Transaction Tax

When you purchase a house in Scotland, you will need to pay additional fees on top of the purchase price. In Scotland, it is known as Land and Buildings Transaction Tax, or LBTT. It is often referred to as stamp duty.

There are a wide variety of properties available at Grandhome, from 2 and 3-bedroom apartments to detached and semi-detached houses and bungalows, all within walking distance all your daily needs. As you begin to look for your new home, you should be aware of LBTT or stamp duty rates and how much you will need to pay.

On 1 April, the Land and Buildings Transaction Tax rate in Scotland changed, and we have answered the most frequently asked questions to get you started.

What is Land and Buildings Transaction Tax, or LBTT?

Land and Buildings Transaction Tax, or stamp duty Scotland, is a payment that anyone buying a property costing more than £145,000 must pay. It is similar to the rest of the UK, but the thresholds in Scotland are slightly different.

When did the LBTT ‘holiday’ end in Scotland?

Between July 2020 and March 2021, there was a temporary holiday on Land and Buildings Transaction Tax due to the COVID-19 pandemic. However, on 1 April, the LBTT reverted to its normal rate in Scotland.

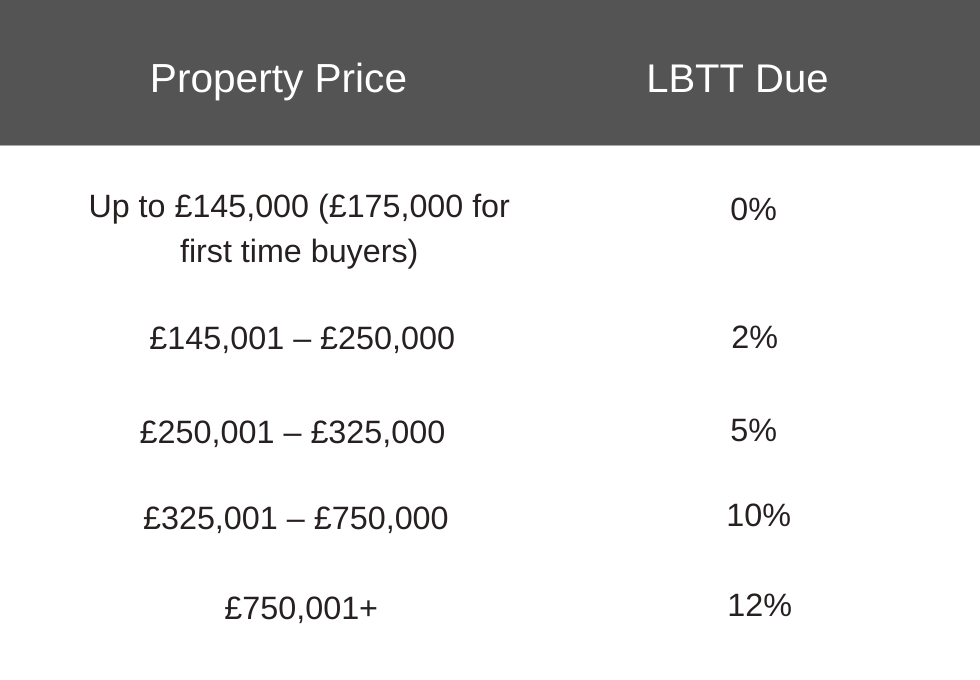

If you purchased a home after 31 March, you will have missed the holiday deadline and will need to pay the standard rate. You can calculate how much you will need to pay using the table below.

How do I calculate how much LBTT (stamp duty Scotland) will I need to pay?

Land and Buildings Transaction Tax (LBTT) in Scotland is payable on a house that costs £145,000 or more. The percentage you need to pay increases as the house price increases.

You will need to pay tax on part of that property within each band shown in the below table.

If you still need more information on how much you will need to pay, The Scottish Government have created a calculator to help you work it out.

How much LBTT do I need to pay on my second home in Scotland?

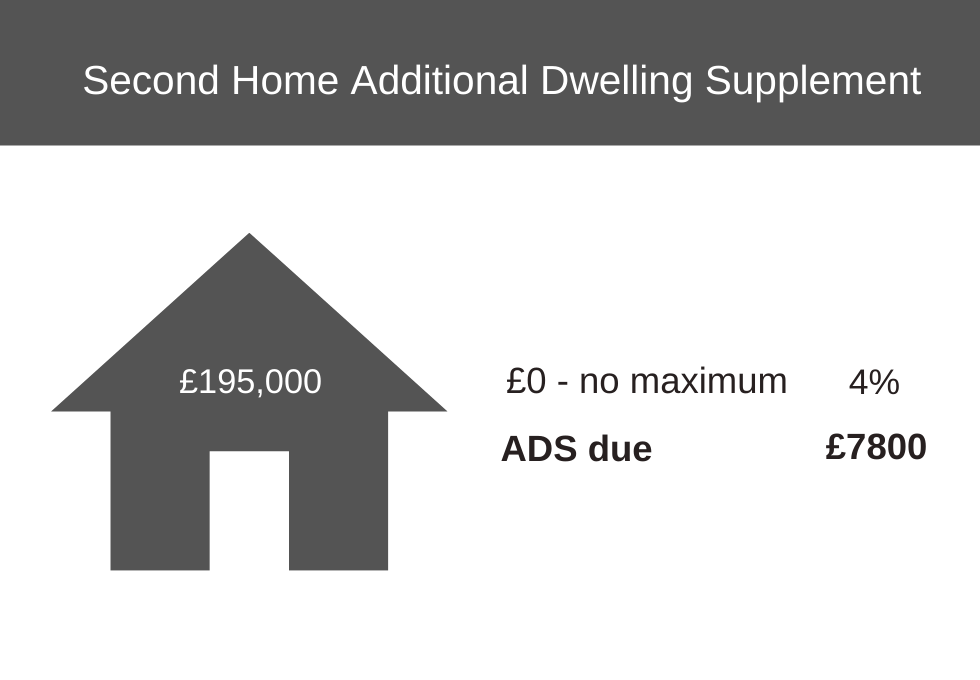

If you own a home already and you are buying a second property, either as a second home or buy-to-let property costing more than £40,000, you will need to pay extra. The amount that you need to pay is 4% of the total house price in Scotland and is known as Additional Dwelling Supplement (ADS).

The 4% tax on a second home applies to both leasehold and freehold properties and needs to be paid whether you are buying outright or with a mortgage.

Find out more about the Additional Dwelling Supplement on the Revenue Scotland website.

I live in England, but I want to buy a second home in Scotland. Do I need to pay extra?

If you live in England or Wales but are considering purchasing a second home in Scotland, you will need to pay 4% of the total house price as the Additional Dwelling supplement.

Do I need to pay LBTT as a first-time buyer in Scotland?

If you are a first-time buyer then you might just be in luck! You will not have to pay Land and Buildings Transaction Tax or stamp duty on the first £175,000 of a new property.

For example, a CALA homes three-bedroom house costing £258,000 is above the threshold, so LBTT must be paid between £175,000 and £258,000. Therefore, at the rate of 2% and the higher rate of 5%, the LBTT due would be £1,900.

Ready to start looking for your new home?

For those looking for a new home near Aberdeen, the Grandhome community offers countryside living on outskirts of the city of Aberdeen which aims to deliver unprecedented standards. View our homes for sale now.